HARTFORD, Conn., and BOSTON – June 28, 2023 – Nassau Financial Group (“Nassau”) today announced an agreement with LifeYield, a financial technology company specializing in applications that help advisors and independent insurance producers optimize retirement income, maximize Social Security, and minimize tax drag on investments for their clients. This collaboration is intended to help advance the ability of independent producers to create retirement income protection for more Americans through education, emerging retiretech technology, and annuities.

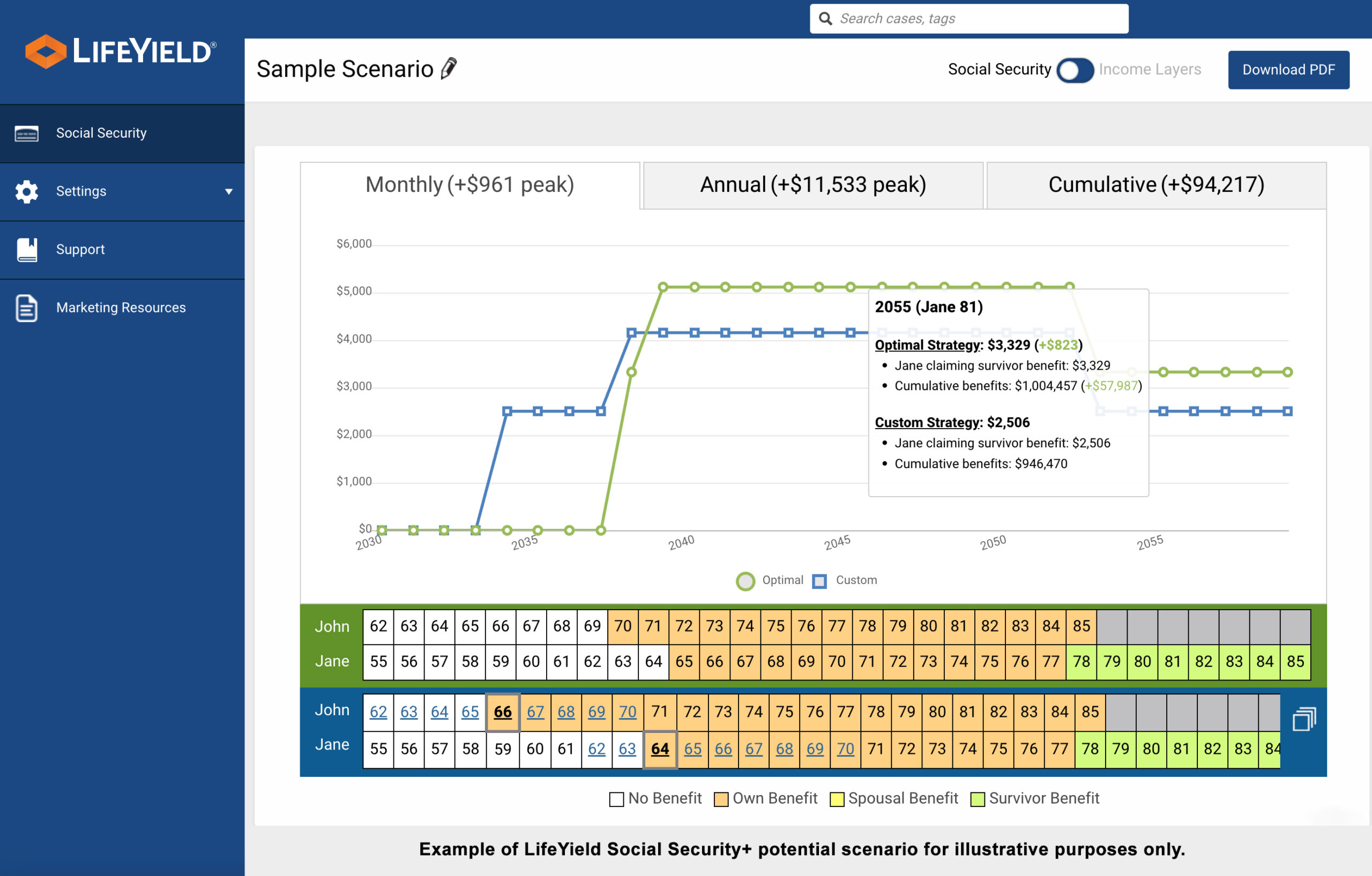

Nassau will integrate LifeYield’s “Social Security+ with Income Layers” application into its retiretech toolbox for use by independent producers. This application models Social Security benefits under different scenarios. Producers can then help clients by showing potential options for converting assets into reliable income streams to supplement Social Security benefits.

“Nassau’s collaboration with LifeYield demonstrates our long-term focus on providing leading digital capabilities to help insurance producers develop strong retirement income strategies for each client,” said Tom Buckingham, Chief Growth Officer at Nassau.

“We are excited about the future of technology in retirement planning, from setting goals through seeking to protect savings, deliver guaranteed income, and pay for health care costs,” Buckingham added. “By partnering with LifeYield, we align with a leader for technology designed to maximize retirement income, broadening our commitment to insurtech beyond our incubator, Nassau Re/Imagine.”

LifeYield Vice President Jeff Quigley said the first question people approaching retirement ask their producer is, “What can I expect from Social Security?”

“Producers use Social Security+ to demonstrate how income history, age, and marital status affect lifetime benefits. Then producers use the application’s Income Layers feature to evaluate potential income sources to seek to close the gap between Social Security benefits and monthly income needs.

“This opens the door to constructive discussions about retirement planning, including savings levels, investment options, and products, like annuities and life insurance, that may be appropriate,” Quigley said.

About Nassau Financial Group

Based in Hartford, Connecticut, Nassau Financial Group is a growth focused and digitally enabled financial services company with three distinct and closely connected businesses: insurance, reinsurance, and asset management. Nassau was founded in 2015 and has $22.1 billion in assets under management, approximately $1.4 billion in total adjusted capital, and about 378,000 policies and contracts. Nassau’s fixed and fixed indexed annuity products are issued by Nassau Life and Annuity Company (Hartford, CT) and Nassau Life Insurance Company (East Greenbush, NY), subsidiaries of Nassau Financial Group. Nassau is NOT connected with, recommended by, or endorsed by any governmental program, agency, or entity, including the Social Security Administration. For more information, visit nfg.com.

About LifeYield

LifeYield is a technology company whose goal is to improve investor outcomes by minimizing investment taxes and maximizing retirement income. Major financial services firms integrate LifeYield APIs with their proprietary platforms to automate ongoing asset location, tax harvesting, transitions, withdrawals, multi-account rebalancing, and retirement income optimization. LifeYield’s goal is to increase advisor productivity and improve financial results for investors, advisors, and firms. For more information, visit lifeyield.com.

Contacts

Shin-Jung Hong, Nicholas & Lence Communications

ShinJung@nicholaslence.com

Alice S. Ericson, Nassau Financial Group

aericson@nfg.com

Matthew Nollman, LifeYield

Matthew.nollman@lifeyield.com

Nassau News

Nassau News